Search VernonNow

Canada’s real GDP declined by 0.4 per cent from April to June this year when compared with January to March, Statistics Canada data show.

It comes after the economy grew by 0.5 per cent in the first three months of 2025.

The agency said the contraction – which, if it persisted for a full year, would amount to a 1.6 per cent decline – came amid a “significant decline” in exports to the United States.

It was also a consequence of “decreased business investment in machinery and equipment,” StatCan said in its release this morning.

On a per capita basis, meanwhile, real GDP declined by 0.4 per cent in the second quarter. In the first quarter, it increased by 0.4 per cent.

StatCan also found that:

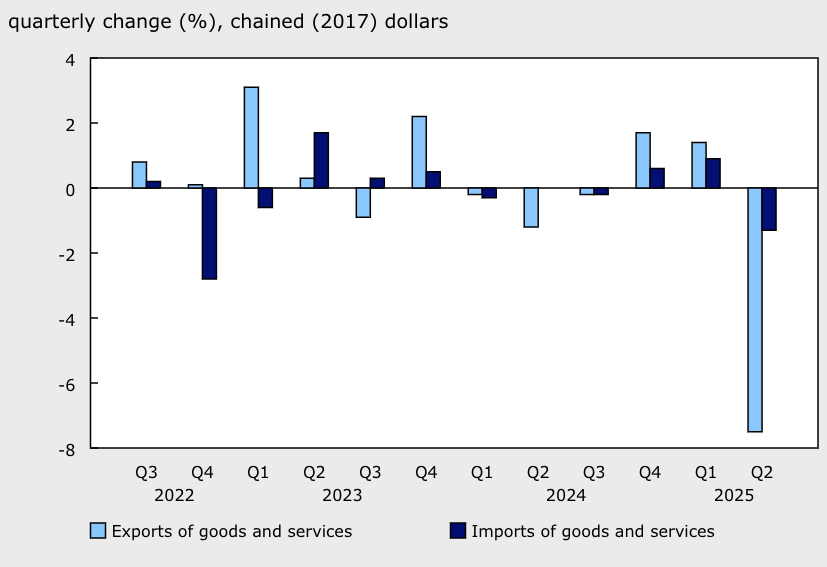

Exports declined 7.5 per cent in the second quarter

Car and truck exports were down 24.7 per cent and industrial machinery 18.5 per cent

Imports declined 1.3 per cent

Household spending increased 1.1 per cent, led by spending on new trucks, vans and SUVs (up 5.6 per cent)

Spending on booze declined 3.9 per cent, while spending on electricity declined 3.2 per cent

Residential investments increased by 1.5 per cent

Compensation for workers increased 0.2 per cent, the smallest increase since the second quarter of 2016

The household saving rate fell to five per cent, down from six per cent in the first quarter

Government revenue fell 4.2 per cent, with StatsCan blaming the removal of the federal carbon tax

Despite that, federal government expenditure increased by 1.8 per cent

StatCan said the decline in imports was due in part to the “counter-tariff response” to the US by Ottawa.

But it also said the huge decline in exports, particularly of vehicles, was “a consequence of United States-imposed tariffs.”

The reaction to the data has so far been negative, with market strategist James E. Thorne warning the Canadian economy was in for a “hard landing” amid “downward momentum.”

Pollster David Coletto, who runs Abacus Data, said “now the pain will begin,” adding that he is watching “how Canadians react.”

Big miss in Canada GDP.

— James E. Thorne (@DrJStrategy) August 29, 2025

An economy with downward momentum rapidly accelerating.

Yes a hard landing in Canada.

BOC is late. Why the overnight rate is not significantly below 2% is beyond me.

Tiff Macklem is this cycle reincarnation of John Crow. pic.twitter.com/GZNSe4OmJK

Canada’s largest bank, meanwhile, said the GDP figures today were “weaker than expected,” but pointed to StatCan’s preliminary estimate that GDP increased 0.1 per cent in July.

In a note, RBC added: “Our base-case forecast still assumes GDP growth will be slow, but positive, through the second half of 2025, with Canada’s relatively favorable [sic] tariff position compared with other US trade partners should help limit downside risks and reduce the likelihood of a slide into recessionary territory.”

In its July decision, the Bank of Canada chose to keep its key interest rate at 2.75 per cent, where it’s been since March. That disappointed some Canadian leaders, including Ontario Premier Doug Ford, who has long argued for the economy to be stimulated by lower borrowing rates.

The Bank of Canada’s next decision is due on Sept. 17.