Search VernonNow

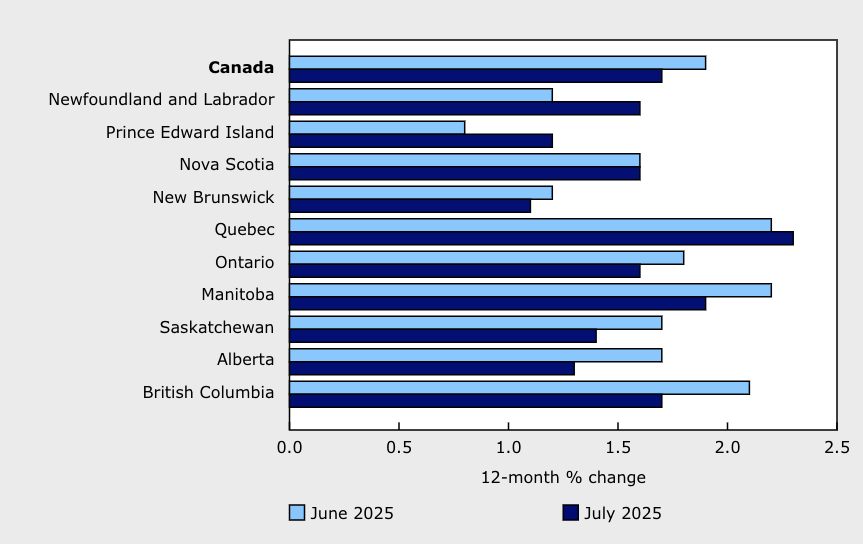

Canada’s annual inflation rate declined to 1.7 per cent in July, according to the latest data from Statistics Canada.

That’s down from 1.9 per cent in June.

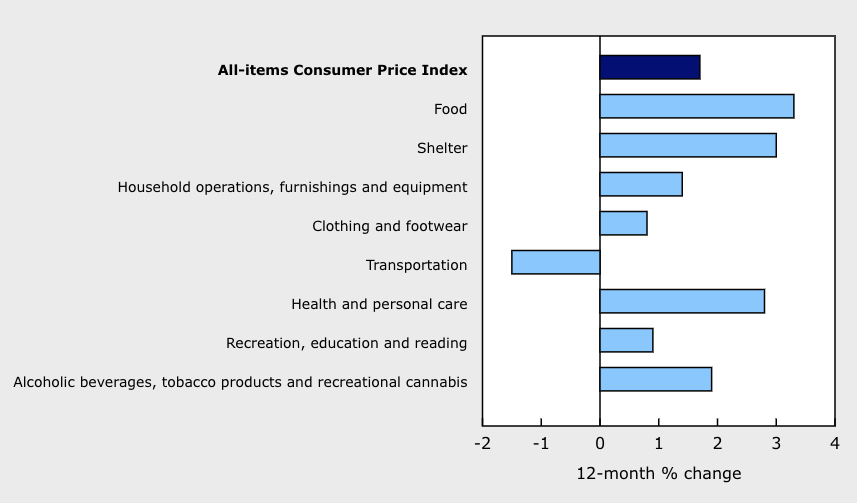

The agency said the easing of the speed of price increases was due to a 16.1 per cent annual decline in the price of gas in July, following a 13.4 per cent decline in June.

But food, housing, clothing, healthcare, booze and recreation all increased in price in July, meaning that, without the fall in gas prices, inflation would have been 2.5 per cent in July.

“Lower crude oil prices, following the ceasefire between Iran and Israel, contributed to the decline [in gas prices]," StatsCan said in its inflation report this morning.

“In addition, increased supply from the Organization of the Petroleum Exporting Countries and its partners (OPEC+) put downward pressure on the index.”

In housing, however, rent increased by 5.1 per cent in July compared with 12 months earlier. It increased by 4.7 per cent in June.

British Columbia was one of the worst-hit provinces, with rent prices increasing by an average of 4.8 per cent last month. BC’s overall inflation rate matched Canada’s at 1.7 per cent.

Grocery prices, meanwhile, continued their inexorable rise in July, with food bought at stores up 3.4 per cent in July compared with the previous year.

Coffee prices have surged by 28.6 per cent, according to StatsCan, due to “unfavourable weather conditions in growing regions.”

Confectionary also saw a noticeable increase at 11.8 per cent, while fruit was up 3.9 per cent, with grapes surging by 29.7 per cent.

“As of July 2025, Canadians were paying 27.1 per cent more for food purchased from stores than they were in July 2020,” the agency explained.

The Bank of Canada chose to once again hold its key interest rate at 2.75 per cent last month, prompting dismay from Ontario Premier Doug Ford among other officials.

In its summary of its decision, the Bank said Canada's economy was showing signs of "resilience," but added that uncertainty related to global trade created an "unpredictable" environment.

It did say, however, that if Canada and the US agreed on lower tariffs, there would be a reduction in "the direct upward pressure on inflation," while increased tariffs "would increase it.”

“If a weakening economy puts further downward pressure on inflation and the upward price pressures from the trade disruptions are contained, there may be a need for a reduction in the policy interest rate," the Bank concluded.

The next interest rate decision is set to be announced on Sept. 17.